Return to Shareholders

Ensuring a Fair Return to Shareholders

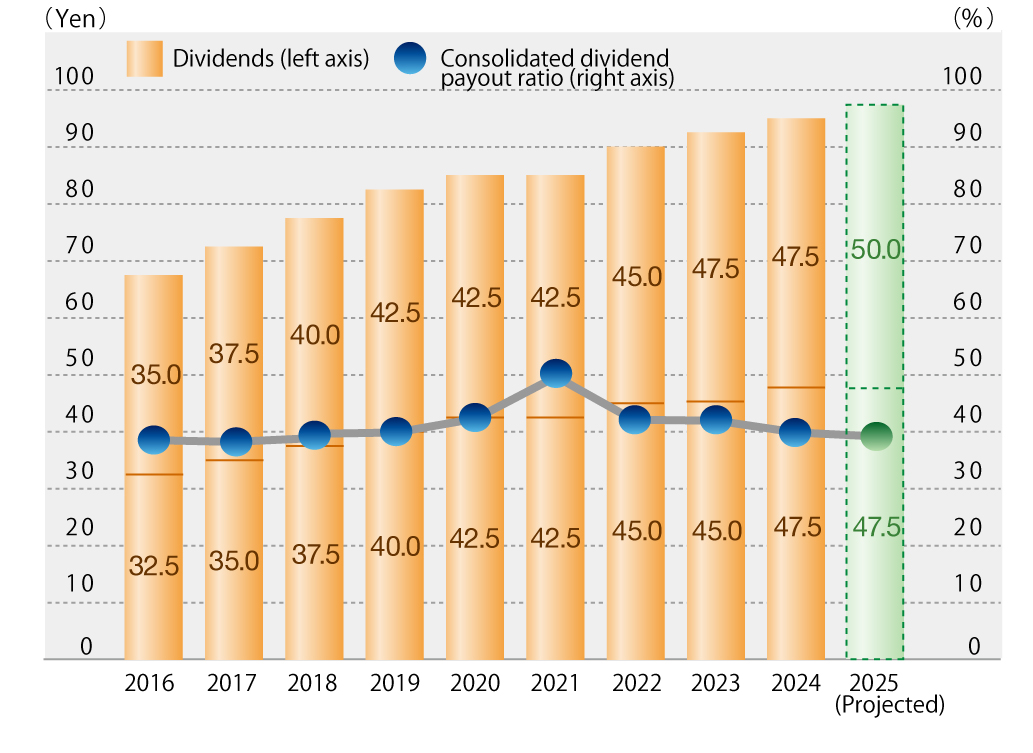

We consider the return of profits to shareholders a crucial management task, and determine the consolidated dividend payout ratio and the level of internal reserves in overall consideration of the future expansion of our business and consolidated results of operations while keeping in line with the basic policy that ensures the continued and stable dividend payments.

Our basic policy of distribution of surplus in the form of dividend payment is that the Company makes it a rule to distribute dividends twice annually, in the form of an interim dividend, with a record date of September 30 each year, which is paid by resolution of the Board of Directors, and a year-end dividend, with a record date of March 31 each year, which is paid by resolution of the General Meeting of Shareholders.

We intend to use internal reserves for investments required for increased new customer contracts, research and development, other strategic investments, and measures to return profits to employees so as to ensure to strengthen our corporate structure and expand our business.

Years ended March 31

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 (Projected) |

|

Annual Dividends (Yen) |

72.5 [35.0] |

77.5 [37.5] |

82.5 [40.0] |

85.0 [42.5] |

85.0 [42.5] |

90.0 [45.0] |

92.5 [45.0] |

95.0 [47.5] |

97.5 [47.5] |

100.0 [50.0] |

| Consolidated dividend payout ratio (%) | 37.6 | 38.9 | 39.1 | 41.7 | 49.7 | 41.7 | 41.6 | 39.4 | 37.5 | 39.5 |

Information for Individual Investors