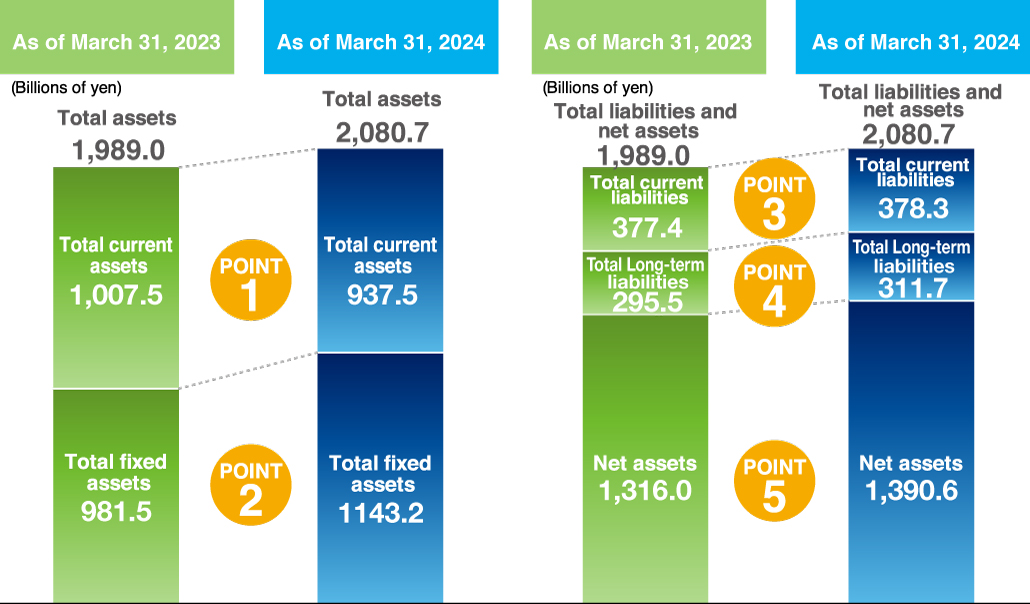

Assets and Liabilities

POINT1Graph

Total current assets, at 968.8 billion yen, were up 3.3% or 31.2 billion yen. This was largely attributable to the recognition of call loan of 28.0 billion yen and the increases in securities by 77.4% or 15.2 billion yen to 34.8 billion yen and other by 28.4% or 10.1 billion yen to 46.1 billion yen, despite the decrease in cash and deposits by 7.3% or 32.1 billion yen to 408.7 billion yen.

POINT2Graph

Total non-current assets, at 1,176.7 billion yen, were up 2.9% or 33.5 billion yen. This was mainly attributable to the increases in property, plant and equipment by 3.9% or 16.9 billion yen to 449.2 billion yen and investment securities by 2.3% or 9.9 billion yen to 435.6 billion yen.

POINT3Graph

Total current liabilities amounted to 379.3 billion yen, up 0.3% or 0.9 billion yen, owing to the increase in short-term borrowings by 17.3% or 4.6 billion yen to 31.5 billion yen, despite the decrease in accounts payable - other by 6.0% or 3.0 billion yen to 47.9 billion yen.

POINT4Graph

Total non-current liabilities increased by 2.2% or 6.7 billion yen to 318.5 billion yen, compared to those at the end of the previous fiscal year, mainly attributable to the increase in deferred tax liabilities by 27.6% or 5.4 billion yen to 25.2 billion yen.

POINT5Graph

Total net assets amounted to 1,447.7 billion yen, 4.1% or 57.0 billion yen higher than those at the end of the previous fiscal year, mainly due to the increases in retained earnings by 5.9% or 68.4 billion yen and foreign currency translation adjustment by 57.1% or 12.7 billion yen, despite the decrease in treasury shares by 17.8% of 26.7 billion yen.

Note: From the fiscal year ended March 31, 2025, the Company has partially revised the English labels of its financial statement accounts to conform with the EDINET Taxonomy provided by the Financial Services Agency. However, it should be noted that these revisions are superficial changes to the account labels and do not change their substance.