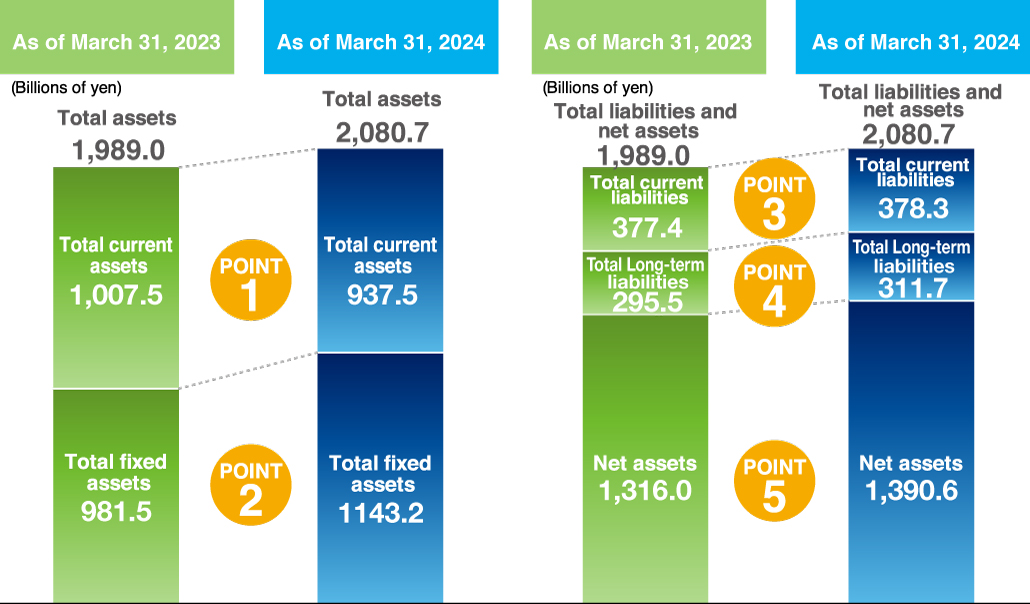

Assets and Liabilities

POINT1Graph

Total current assets, at 1,007.5 billion yen, were up 2.2% or 21.3 billion yen. This was largely attributable to the increases in notes and accounts receivable - trade and contract assets by 5.1% or 7.5 billion yen to 157.4 billion yen, raw materials and supplies by 32.7% or 4.5 billion yen to 18.4 billion yen and due from subscribers by 10.2% or 4.0 billion yen to 43.5 billion yen.

POINT2Graph

Total fixed assets, at 981.5 billion yen, were up 6.5% or 59.9 billion yen. This was mainly attributable to the increases in investment securities by 8.0% or 22.1 billion yen to 298.3 billion yen, intangible assets by 15.2% or 17.5 billion yen to 132.7 billion yen and total tangible assets by 3.4% or 13.3 billion yen to 403.8 billion yen.

POINT3Graph

Total current liabilities amounted to 377.4 billion yen, up 4.3% or 15.7 billion yen, owing to the increase in other by 78.9% or 13.4 billion yen to 30.4 billion yen mainly due to the increase in accounts payable for equipment.

POINT4Graph

Long-term liabilities increased by 1.9% or 5.5 billion yen to 295.5 billion yen, compared to those at the end of the previous fiscal year, mainly attributable to the increases in deferred income taxes by 59.0% or 4.0 billion yen to 10.9 billion yen and net defined benefit liability by 9.3% or 2.0 billion yen to 23.9 billion yen.

POINT5Graph

Total net assets amounted to 1,316.0 billion yen, 4.8% or 60.0 billion yen higher than those at the end of the previous fiscal year, mainly due to the increases in retained earnings by 5.5% or 57.0 billion yen, foreign currency translation adjustments by 16.1 billion yen and noncontrolling interests by 13.6% or 18.1 billion yen, despite the decrease in common stock in treasury, at cost by 37.5% or 29.7 billion yen.